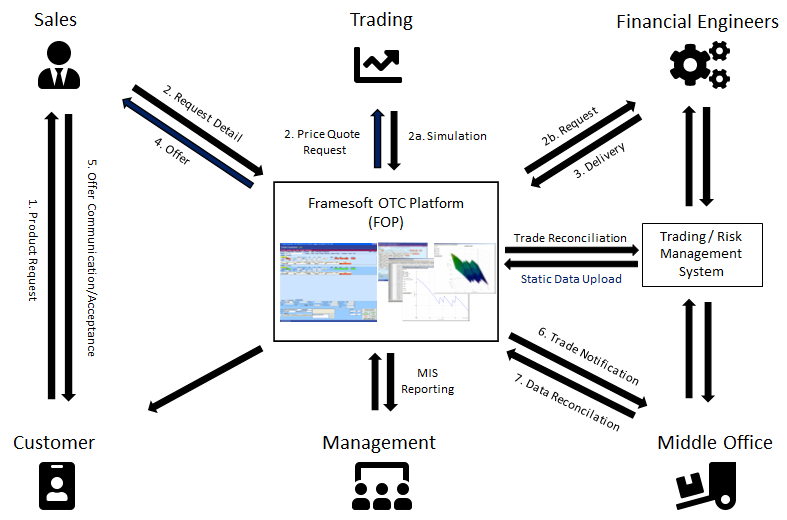

High transaction volumes and increasingly complex structures are creating a real challenge for derivatives sales organizations. Framesoft's OTC Platform (FOP) addresses the day-to-day needs of both sales and trading by supporting typical workflows in structuring, simulating and selling OTC derivatives.

Framesoft's OTC Platform (FOP) helps organizations involved in derivatives trading and sales to eliminate operational risk by electronically supporting every single step in the derivatives sales cycle.

FOP is tightly linked to the trading system via two-way interface. Price requests, simulations and trades can thereby easily be processed without any manual intervention.

Framesoft's OTC Platform (FOP) not only captures derivatives transactions of pre-configured structures but also supports the product creation process itself. FOP allows the design of arbitrary new product structures and makes those structures available to sales & trading or Financial Engineering.

Complementary to the capturing of transactions based on pre-configured structures FOP provides a "free format" term sheet creation & negotiation module which allows users to electronically support and capture even very exotic, new or rarely traded structures.

Main Features

- New products can be defined, configured & traded instantaneously via a “free format” term sheet module which allows users to electronically support / capture even very exotic, new or rarely traded structures

- Direct link to information from the Central Customer Database and to Framesoft Contract Repository (FCR) to check if Master Agreements are in place for a selected potential customer

- Eliminates typical operational risks (misunderstandings, lost tickets, inconsistent confirms) involved in structuring & selling complex structured OTC derivatives by electronically supporting each step in the derivatives sales cycle

- FOP keeps track of open quotes & supports Sales in the process of following up with the customer

- FOP is tightly linked to the client's trading system and trade results are transferred directly into the Bank’s Risk Management System and Customer Database

- Trades (even Multi Product Trades) can be split into Multi CP Transactions at trade capture time, providing an increase in Straight Through Processing (STP)

- Typical option sensitivities can be analyzed by means of a 2D / 3D graphics simulation engine

- Perform extensive simulations to tailor a product to customers’ needs

- Calculations can be performed by the pricing engine of the risk management system or any dedicated pricing engine embedded or connected to FOP

- Indicative Pricing can be obtained on demand from the pricing engine of the risk management system or embedded FOP pricing engine

- Support of a variety of trade modes and workflows such as Good Till, Live Quote, Intraday Forwards, Limit Quote and Best Effort Quote

- Pay-off analyzer module can be used to illustrate pay-offs of exotic structures and Multi Product trades and how the parameters of the structure components influence the pay offs

- All Simulation Results can be exported into MS Office documents, where they can be used for the creation of dedicated customer offerings

- 4-Eye Approval - each stage of the Trade can be made subject of approval

- Full audit trail functionality

- Extensive MIS Reporting & Analysis Capabilities

- Security concept down to single field level ensures that e.g., the “Sales quoted price” can only be entered by Sales

- Integration with Framesoft Data Insight (FDI)

Contact us at