- Details

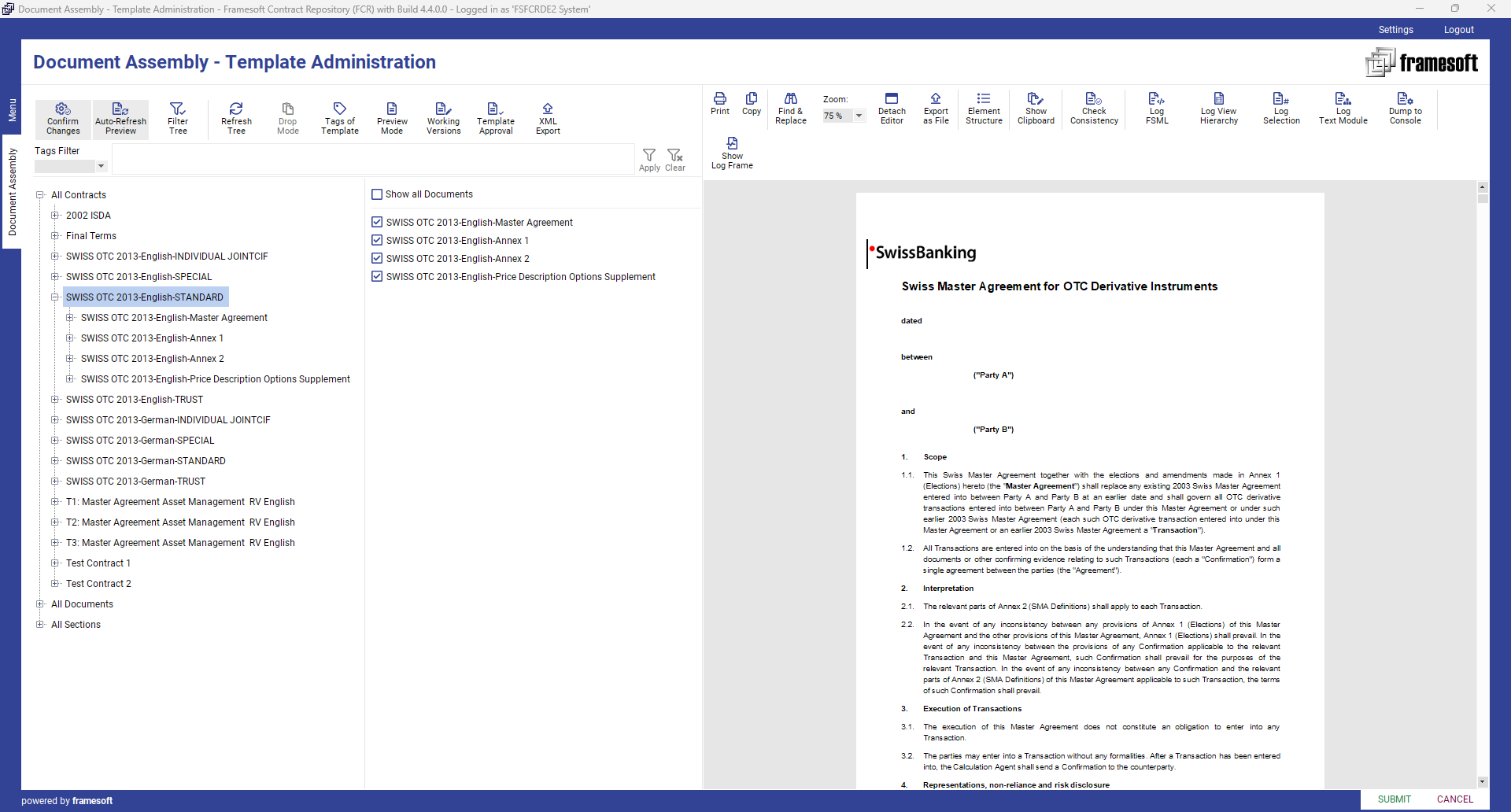

Zug, Jan 30, 2024: Framesoft is delighted to announce the successful integration of Framesoft Document Assembly (FDA) by a prominent European Financial Institution, now employed as the universal contract template assembly tool within the Framesoft Contract Repository (FCR). This integration marks the completion of the initial setup of clauses and prioritized contract type templates in FDA, seamlessly connected to the contract request workflow. This pivotal link ensures the efficient generation of contracts in the "Produce First Draft" task.

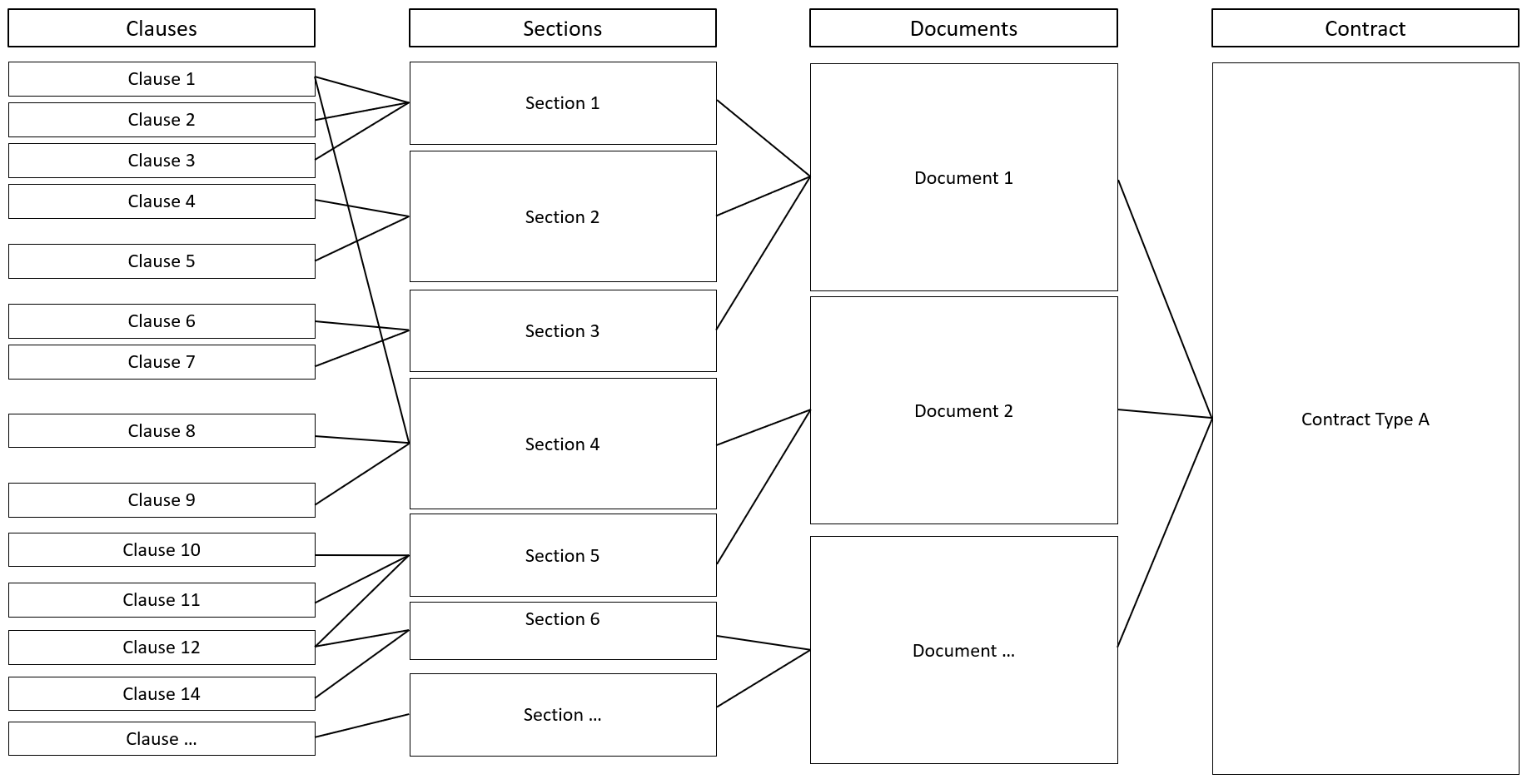

The FDA significantly enhances the efficiency of the document template creation process. It enables a flexible and intuitive online configuration of "Contract Templates" and their constituent components, such as documents, sections, and clauses.

Each component, once created within the Document Assembly module, can be utilized across multiple contract templates, fostering consistency and efficiency. Subsequent updates to any document template component are meticulously managed, with each alteration leading to the creation of a new version. This rigorous version control ensures that all previous iterations remain accessible for audit purposes, thus maintaining a comprehensive and transparent audit trail.

For more information refer to Framesoft Document Assembly (FDA).

- Details

Zug, Jan 29, 2024: Contract Management - A Strategic Imperative

Elevate your enterprise with Framesoft Contract Management (FCM)! Embrace the power of strategic contract management to turbocharge your operations, bolster financial performance, and slash risks. Dive into the future with FCM, your partner in navigating complex contract landscapes. Discover the FCM difference and revolutionize your contract processes. Step into a new era of efficiency at Framesoft Contract Management.

Transform today, triumph tomorrow!

- Details

Zug, Oct 26, 2023: Framesoft Document Assembly (FDA)

Framesoft announces the release of the new Framesoft Document Assembly (FDA) version.

Framesoft Document Assembly (FDA) is nothing short of a revolutionary tool that is transforming the way organizations create and manage documents.

Using FDA is a game-changing innovation of the document automation strategy via combining automation, data integration, pre-designed template clauses and rules to generate new, tailor-made documents with astonishing speed and accuracy. But the thrills do not end with the document generation. Via workflow automation documents generated are provided for review, approval, e-signatures, and distribution making the process efficient from start to finish.

FDA Components

1. Clause Library

These are not just any clauses; they are often intricate blueprints designed to ensure that each document created conforms to specific stylistic guidelines, legal requirements, and branding elements. Clauses feature placeholders for variable content, making them dynamic and adaptable.

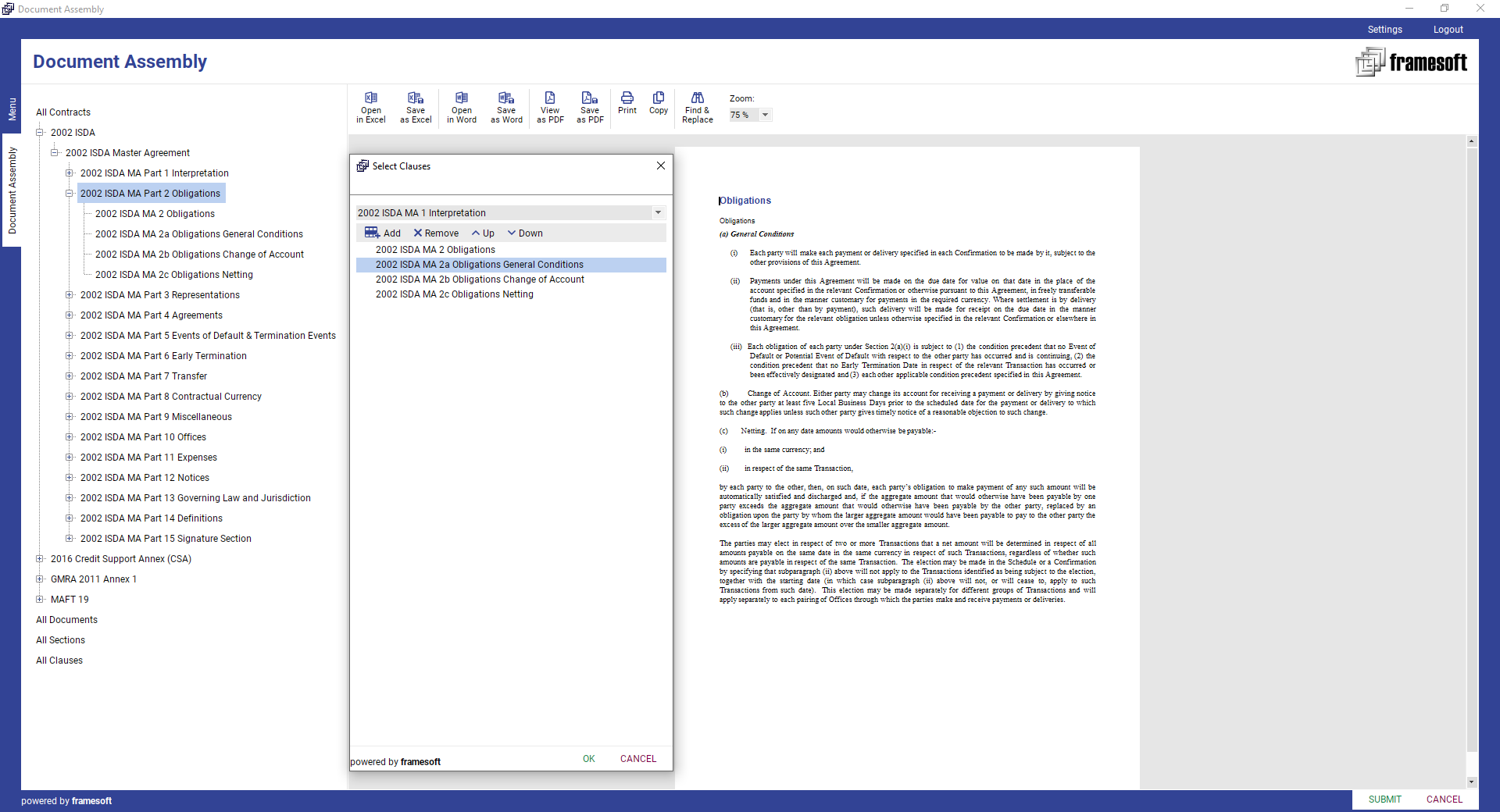

2. Document Template Assembly

By using Framesoft Document Assembly (FDA) clauses can be assembled to new or existing sections, sub-documents, and document templates on the fly. Upon its creation or update any element will be part of an approval process before being released for automated document generation.

3. Database Integration

Framesoft Document Assembly (FDA) can pull information from existing databases to populate fields and / or apply conditional logic.

4. Conditional Logic

This is a set of rules and guidelines that dictate how data is populated into the clause. For example, certain paragraphs or clauses may only appear under specific conditions.

5. Document Generation

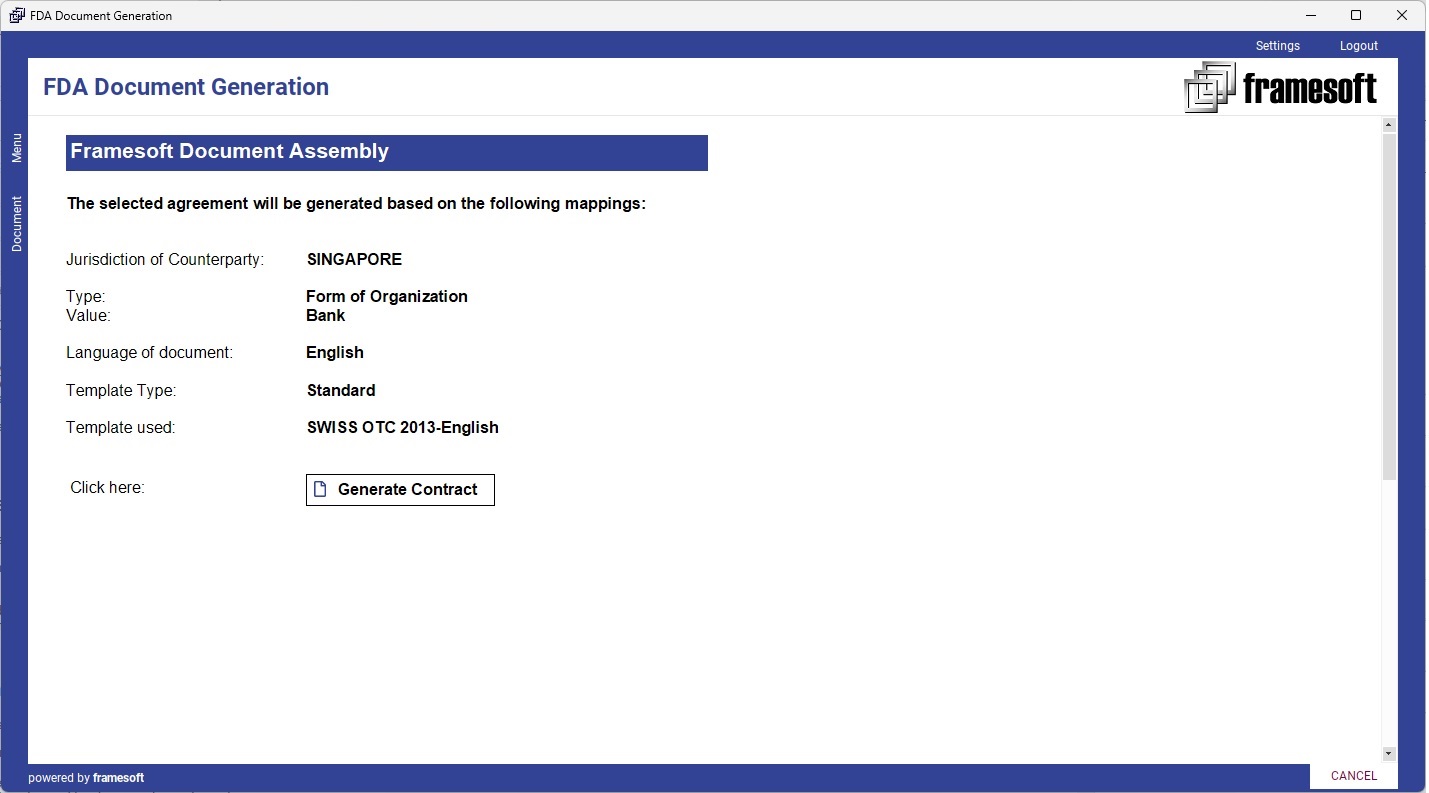

Document Templates designed in FDA can be directly used for a document generation as follows:

- Generation integrated in Document Request Workflow

- (Re-) Generation of a manually selected document

- Document generation triggered via API call

- Further document generation actions defined

The corresponding FDA document templates are selected automatically based on a mapping applied (e.g., Product, Agreement Type, Form of Organization & Jurisdiction, place of issuance or any other criteria).

6. Post Generation Editing

When a document is generated it is presented in the document editor (Framesoft Docs) and post generation editing is supported. Any update of a clause will automatically create a new clause “revision number” which is tracked in addition to the template clause version. This allows tracking all

- Clause versions used in the document generation

- Clauses edited upon generation

7. Version Control & Lifecycle Management

Features that track changes, maintain multiple versions, and manage the lifecycle of clauses, templates and documents are included such as e.g.,:

- View all clause & template / document version

- Generated document search

- Clause (version) usage search

- What if analysis – which generated documents would be affected by a potential clause update.

8. Workflow Automation

Advanced workflow functionalities that route the assembled & generated document for review, approval, e-signature, and distribution.

9. Output Formats

Once assembled, documents can be produced in various formats such as PDF, MS Word, or HTML, depending on the requirements.

10. Document Negotiation

Conduct document reviews & negotiations based on generated documents directly via Framesoft Online Negotiation (FON) and being supported in:

- Document negotiation with multiple parties

- Simultaneous document revisions by the parties involved

- Merge Handling - updates directly pushed into a negotiated document in case of new clause versions, data points or individual updates of clauses.

- Automated document generation triggered by clause or data point updates

- Messaging component for direct communication (chat) between the different parties involved

11. Document Archiving

All generated & related documents from drafts to execution copies are stored in a document archive system such as Framesoft Document Management (FDM).

12. Security & Compliance

Security measures such as encryption, access controls, and audit trails to ensure that sensitive data is protected and compliance with relevant regulations is assured are applied.

Framesoft Document Assembly (FDA) is seamlessly integrated into any Framesoft solutions, such as e.g.,

- Framesoft Document Generator (FDG)

- Framesoft Contract Repository (FCR)

- Framesoft Structured Products(FSP)

- Framesoft Confirmation Generator (FCG).

Automation has been in the focus for large institutions, but truly little has been done to effectively target documentation. It is not only about cost and inefficiency, but also about extremely valuable data not being used.

In the upcoming step planned for 2024, Framesoft AI will be integrated to remove the need for manual processes by analysing and structuring data at the onset of any documentation lifecycle. This will speed up information gathering and decision-making processes tremendously.

Stay tuned for more details.

Contact us at

- Details

Zug, Feb 20, 2023: Framesoft Document Assembly (FDA)

Framesoft announces the release of an updated version of Framesoft Document Assembly (FDA) in April 2023.

Document assembly is one of the critical components of the document automation. Framesoft’s unique Document Assembly (FDA) module includes template & component design, data integration, automatic clause assembly, template, component / clause preview and document generation as part of a workflow (e.g., a contract request workflow) or manually via action.

FDA will dramatically speed up the document template creation process based on a flexible online configuration of any “Master” document and its individual components such as e.g., sub-documents, sections, and clauses. Any component needs to be created once in the Document Assembly module and can then be used in multiple contracts templates. Each update of a document template element will lead to the creation of a new version. All former versions are still available for audit purposes via audit trail.

Conduct a review or contract negotiation of such automatically generated Contract Draft Documents. FDA will take care of:

- “Merge Handling“ of updates pushed into a currently reviewed contract via new standard clause / non-standard versions, data updates or individual updates

- Automated generation of new agreements / amendments triggered by a library clause update

- Automated generation of new agreement / amendment triggered by a contract data point update

For contract lifecycle management an extended Template Repository Search is offered, including

- Template Repository & signed contract search

- Clause search and its versions / usage in contracts

- Search for documents containing selected template components

- What-if-Analysis

Framesoft Document Assembly (FDA) is offered as Add-On to any of our solutions.

For more information, please contact Framesoft at

- Details

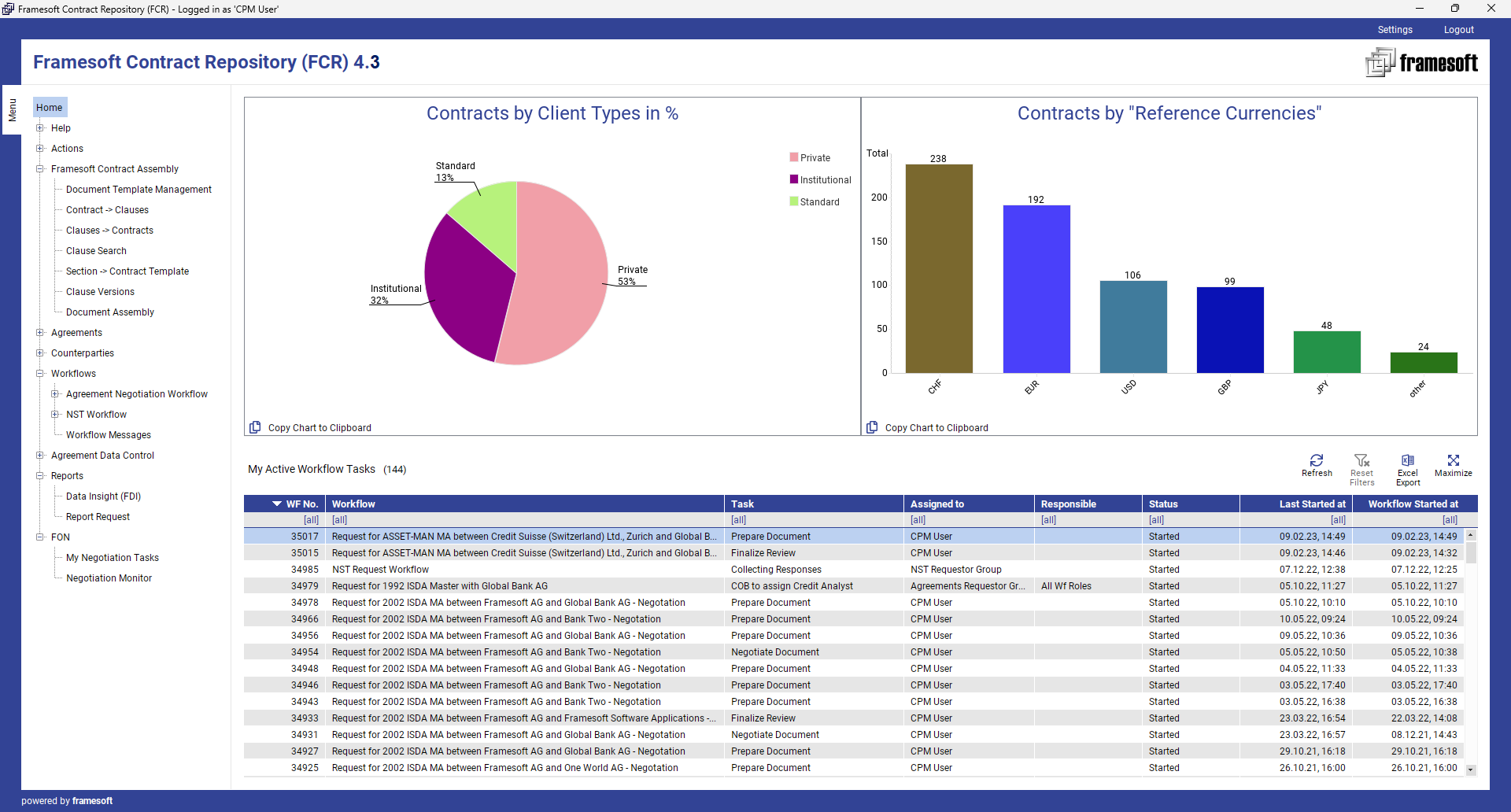

Zug: Feb 20, 2023: One of Europe's largest financial institutions upgraded to Framesoft Contract Repository (FCR) 4.3

After having deployed FCR for more than 15 years for managing master agreements & achieving a significant netting benefit, the new version 4.3 of FCR 4.3 will support the growing global user basis and increase working efficiency by significantly speeding up the client onboarding process.

beside state-of-the-art netting functionality, FCR 4.3 offers an enhanced user interface addressing easy usage combined with powerful configurability. Fine grained access control is applied on the basis of user groups presenting search and overview screens in a tailored fashion.

Furthermore, FCR's workflow engine now supports bundling of workflows, Workflow forking & looping as well as managing of parallel workflows including workflow reunion.

The new FCR version integrates and accelerates document generation and negotiation processes and provides contract lifecycle capabilities via integration of:

- Framesoft Document Assembly (FDA)

- Framesoft Online Negotiation (FON)

- Framesoft Data Insight (FDI)

- Framesoft Agreement API

FCR will be used in all of the customer's banking hubs and branches in Europe, America and Asia.